Perspective – Written by Máté Kováts

This analysis aims to understand how changes in oil prices affect the Russian economy and what factors play a role in changing oil prices. It looks at the period between 2022 and 2025, focusing on the Russian export of crude oil to its trading partners. The findings suggest that changing oil prices significantly influence the Russian economy through its income from crude oil exports. However, the influential factors—like sanctions, OPEC+ announcements, and price caps—sometimes have contradictory results that defy expectations.

The Role of Oil Exports in the Russian Economy

In 2023, Russia accounted for 9.1 percent of the world’s total crude oil exports, making the country the second-largest crude oil exporter globally, behind Saudi Arabia, which exported 16.3 percent of the world’s total crude oil. At the same time, mineral fuels and oils represented approximately 35–40 percent of Russia’s exports. Although there are no exact data on what these exports mean in financial terms, it is safe to say that they are highly important for the Russian economy. For this reason, theoretically, a change in global oil prices is supposed to influence Moscow’s income. In reality, however, the question is more complex. The following sections examine how oil price changes actually affect Russian income from crude oil exports by comparing the volume of crude oil exports with the income from those exports.

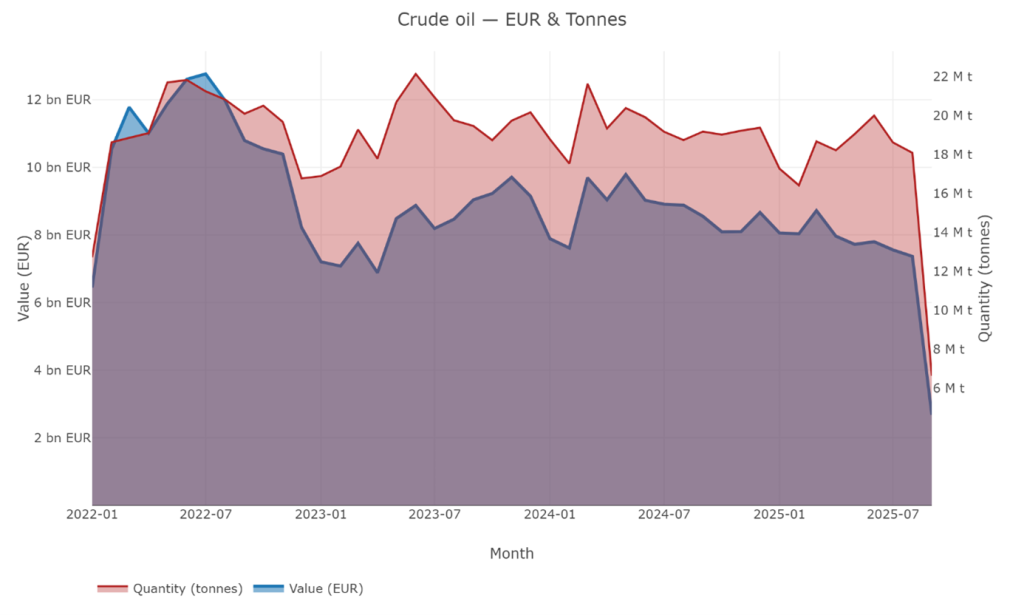

Figure 1. Russia’s Crude Oil Exports in Euros and Tons, 2022–2025. Visualization by author using data from the Russia Fossil Tracker.

The graph above shows the difference between the exported volume and the income from that exported amount between 2022 and 2025. It reveals five periods where the movement of the two variables, which should move in tandem, is dissonant and contradictory: (1) between April 2022 and February 2023, (2) between July 2023 and October 2023, (3) between September 2024 and November 2024, (4) in February 2025, and (5) between April 2025 and June 2025.

In the first case, the decline in Russian income is much sharper than the decrease in export volume, indicating a significant fall in the price of crude oil. This notable drop in price resulted in lower income from crude oil exports for the rest of the period analyzed, since income never returned to the pre-April 2022 level, even during the height of exports. In the rest of the highlighted cases, we see either that the export volume increased but income dropped, which suggests a significant decrease in the price of crude oil, or that the export volume dropped but the income increased, which suggests an increase in the price. The upcoming sections examine the factors that influenced these trends and how the change in the price of crude oil was able to—and still can—influence the Russian economy.

Five Cases of Divergence Between Russia’s Oil Exports and Revenues

- April 2022–February 2023

During the second half of 2022, several factors led to a significant drop in the Russian income from crude oil export. After the beginning of the Russia–Ukraine war, several Western countries announced sanctions on Russian energy imports. Germany announced in April 2022 that it would stop importing oil from Russia by the end of the year. The announcement hit the global oil market, and the price of Russian oil dropped, since Moscow had just lost an important market for its crude oil, which forced the state to look for other buyers. At the same time, the war itself also shook the oil market due to uncertainty about supply chain security, which contributed to generally lower crude oil prices. By the end of 2022, Poland had also announced its intention to join Germany in ending Russian oil imports, and by December, the G7 countries, Australia, and several other European Union member states announced price caps of $60 per barrel on Russian oil imports, which further lowered the value of crude oil exported by Russia. In the same month, as part of its sixth sanction package, the EU and the United Kingdom banned seaborne imports of Russian crude oil. Although pipeline imports of Russian oil were exempt from the ban, a ban on the marine transport of Russian oil restricted both deliveries by sea to EU markets and deliveries to non-EU markets involving EU shipping or insurance. These events collectively led to the most significant drop in Russian income from crude oil exports since the beginning of 2022: Russian income went from €12.76 billion in July 2022 to a mere €7.20 billion in January 2023. Moscow has yet to reach the previous level of income to date.

- July–October 2023

Between July 2023 and October 2023, Russian income increased from €8.19 billion to €9.70 billion while export volume fell from 20.93 megatons to 18.73 megatons. This suggests a significant increase in the price of crude oil on the global market. During this period, OPEC+ kept introducing supply cuts in order to regain control over falling prices, which contributed to a general increase in oil prices. Similarly, the United States tightened its enforcement of the G7 price cap on Russian oil, which also increased global oil prices. At the same time, the conflict in Gaza between Israel and Hamas put the supply chain at risk, which in turn further increased prices. Although the United States strengthened the price caps, several new importers signed deals with Russia, mainly from Asia. They were willing to buy Russian oil above the price cap but below the global market price, which is why Russia still managed to benefit from rising oil prices, even during the stricter market caps.

- September–November 2024

Between September 2024 and November 2024, the opposite happened. The export volume increased from 18.74 megatons to 19.37 megatons, but income decreased from €8.88 billion to €8.10 billion. Two main factors influenced the drop in oil revenues for Russia. The first was slowing demand from China, which hit the Russian oil market hard, since Moscow shifted toward Asian countries like China and India, which had massive demand for oil imports, after the beginning of the Russia–Ukraine war. At the same time, the Brent oil price dropped below $80 per barrel, which further lowered Russian income, since Moscow often sold its crude oil to Asian partners at $5–10 below the Brent price, which was higher than the price caps announced by several Western states but still lower than the global market price. Due to the drop in the Brent price, Russia was forced to lower its own prices, which led to lower revenues.

- February 2025

Around February 2025, Russia’s export volume dropped sharply from 19.37 megatons to 16.42 megatons, but this did not reduce its revenues because the price of Russian crude oil rose. Ukrainian drone strikes repeatedly hit Russian oil refineries, limiting Moscow’s export capacity. At the same time, stricter U.S. and EU enforcement of measures against Russian and Iranian oil drove global crude prices higher. Rising demand from India further boosted Russia’s earnings, as the gap between Brent and Urals prices narrowed, giving Moscow a higher income per barrel.

- April–June 2025

Finally, between April 2025 and June 2025, there was a significant increase in the volume of exports from 18.22 megatons to 20 megatons and a slight drop in incomes from €7.96 billion to €7.79 billion. OPEC+ announced several increases in production volume, which benefited mainly Saudi Arabia due to its ability to quickly adapt to a larger volume of production. Later on, this increased production by Saudi Arabia forced Russia to lower the Urals price to be able to match the Saudi prices and keep its trading partners. During this period, the Urals dropped to approximately $53 per barrel, which forced Russia to increase its volume of exports in order to partially compensate for the lower income from crude oil exports.

Conclusion

These cases show that changes in the price of oil can significantly influence Russian income, but the reasons behind the changes in prices are diverse. Prices are often driven primarily by supply and demand, which can dramatically increase or decrease the price of oil and Russian income from crude oil exports. However, decisions by OPEC+ to decrease or increase oil production are also important. Between April 2025 and June 2025, for example, Moscow was forced to lower the Urals price due to increased production by Saudi Arabia, which hit the Russia’s bottom line. At the same time, this analysis suggests that the sanctions and price caps announced by the European Union are not always effective. In multiple cases, Russia actually increased its income when new sanctions or price caps were introduced because growing Asian demand resulted in higher revenues due to increased global oil prices. The so-called “shadow fleet” probably adds additional value to Russian revenues from oil exports, although the lack of accessible data from official sources makes the scale of its impact difficult to calculate.

Changes in oil prices influence the Russian economy because crude oil represents a large share of Russian exports and GDP. Three factors drove the changes in Russian income from crude oil exports between 2022 and 2025: OPEC+ announcements about production volume decreases or increases, Western sanctions and price caps, and demand from the Asian market. In the years ahead, the main threat to Russian income from crude oil exports is a significant decrease in the demand from the Asian market, since China and India import the largest volumes of Russian crude oil, which, on one hand, allows Moscow to keep its revenue from oil exports stable but, on the other hand, also makes the oil sector heavily dependent on these two states.

The full analysis is available here.