Hungary’s Connectivity Strategy is Already Paying Dividends

As the world obsesses over bloc formation and the global economy seems headed towards a split, Hungary is embracing a connectivity-based approach. By emphasising cooperation with countries from all over the world, Hungary made a bet that the future of the world economy is not one of closure and protectionism. The connectivity strategy enables the country to take advantage of geopolitical opportunities to spur economic growth and close the gap with the highly developed countries. Recent data shows that the strategy is paying off.

The industrial manufacturing capacity of many Western countries declined over the last few decades, but the narrow focus on the service sector and profitability proved harmful to Europe’s global competitiveness, while countries like China grew stronger. Formulated in line with the European Union’s reindustrialisation objectives and aspirations of strategic autonomy, the Hungarian government’s strategy successfully expanded the manufacturing sector, largely by attracting foreign investment in projects like the new EV battery plant in Debrecen. Meanwhile, some European countries are still deindustrialising, and ongoing challenges like the energy crisis threaten to drive further deindustrialisation in Europe.

To evaluate the Hungarian strategy empirically, we will examine Purchasing Managers’ Indices (PMIs) for the manufacturing sector. These are survey-based sentiment indices that provide a real-time snapshot of the activity in a given sector. PMI values range from 0 to 100. A value above 50 represents an expansion when compared with the previous month, while a value under 50 represents a contraction.

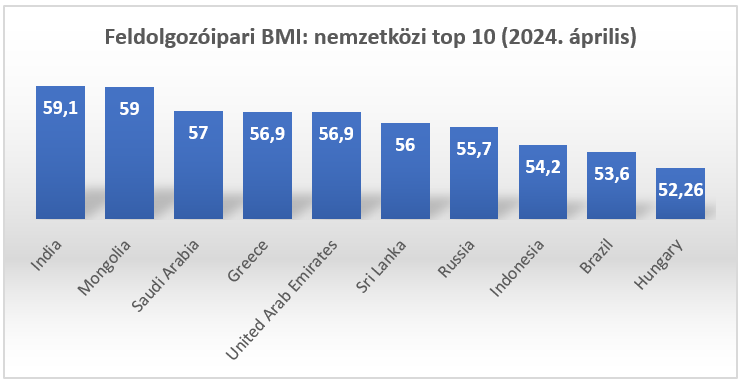

We first look at the top 10 countries in the world by manufacturing PMI for April 2024. These countries’ manufacturing sectors grew the most in the previous month. Among these, Hungary comes in at number 10. Together with Greece, Hungary is one of only two European countries that make the list.

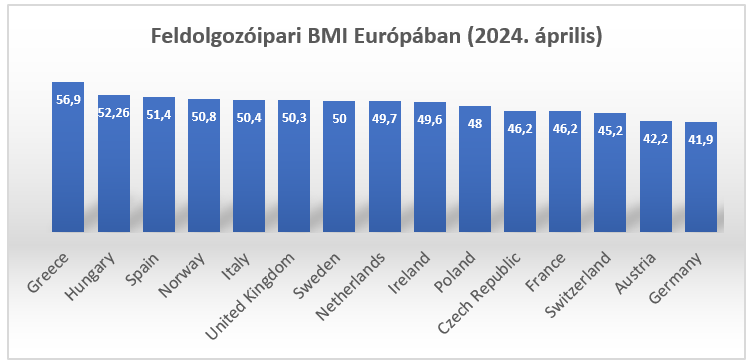

Next, we look at the fifteen European countries that publish PMI indices. Here, Hungary comes in second behind Greece. Notably, more than half of these European countries have seen their manufacturing sector shrink.

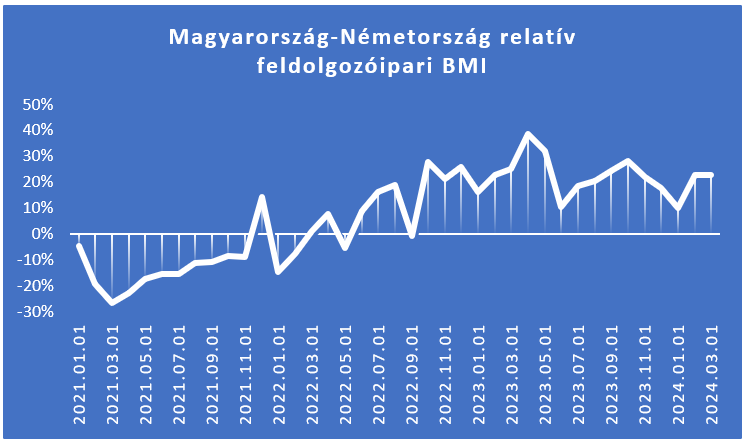

Given the fact that the Hungarian economy is deeply intertwined with the German economy, especially in terms of the automotive sector, we now look at the Hungarian manufacturing PMI relative to the German manufacturing PMI. Germany is one of Europe’s leading manufacturers, but since the second half of 2022, the German manufacturing industry has been shrinking, while the Hungarian manufacturing sector has been expanding. This suggests that Hungary has ‘decoupled’ from German deindustrialisation.

Manufacturing PMI data indicates that Hungary has managed to ‘decouple’ from the general trend of European deindustrialisation plaguing many of its neighbours. Instead, the Hungarian connectivity strategy is allowing the country to continue expanding its manufacturing sector. Hungary is on track to see continued economic growth and close the gap with highly developed countries.

Written by Philip Pilkington